High-price temptations are never a major problem. If something costs hundreds of dollars, I’ll pause and eventually decide that I can’t afford it.

It’s the micro expenses I’m often worried about. I won’t splurge on a $700 flagship, but I’ll casually spend $15 on phone accessories I’ll stop using in weeks. These repetitive costs add up to regret.

I occasionally look back and fail to see the value of purchases, especially with the cost of living increasing. Although I’ve tried budgeting apps, they don’t work if you’re not intentional about your finances.

You could hardly call the methods I use conventional, but they’ve worked effectively to keep me from spending through my phone. Here’s how.

Related

6 hidden gem open source Android apps that save me hundreds on subscriptions

Open source gems that replace pricey subscriptions

8

Delete card details after every purchase

I love the ease of mobile payments. I can link my bank cards directly to my phone for instant checkout or use transfers. But that same perk is partly responsible for overspending.

When my payment method is seconds away, there’s little time between decision-making and spending. I find myself paying for things I don’t think through because my phone made it too easy.

Since I realized this pattern, I’ve been detached mentally and physically. I’ve deleted saved payment methods in my browser and apps.

I have to bring out my cards and type in the details when shopping online. The process takes time, which helps me decide if a purchase is worth it. Most times, it’s not.

Between last month and now, I’ve avoided at least eight impulse transfers and random online checkouts. If I average each of those at around $15 to $20, that’s roughly $120 to $160 saved.

The less accessible my money is, the less I touch it.

7

Create a reflection list with Google Keep

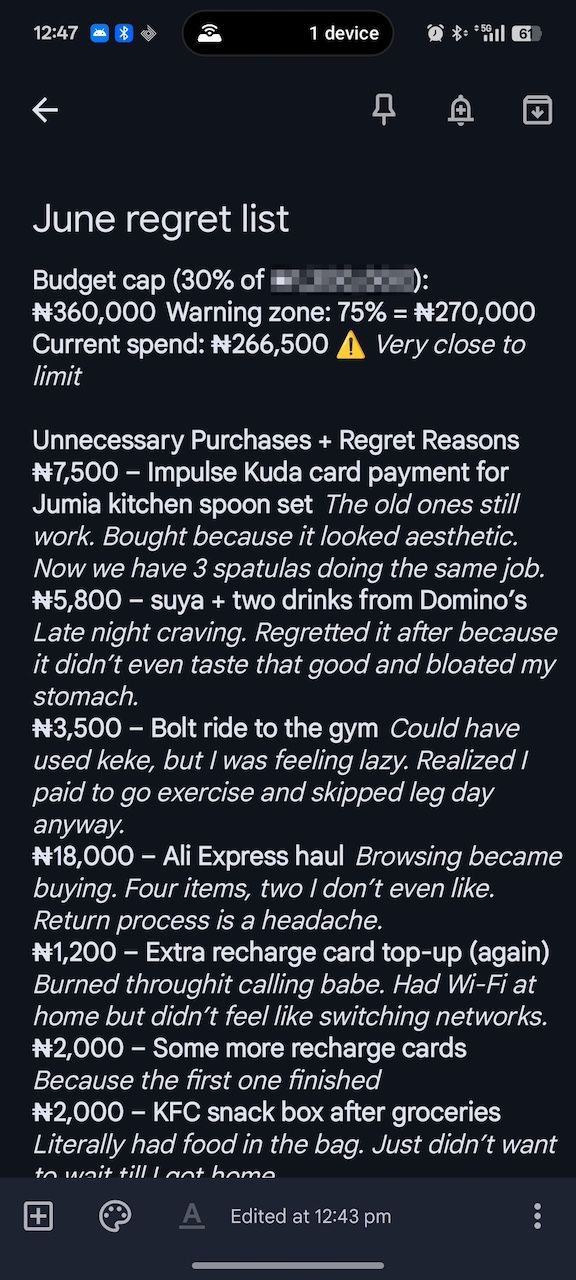

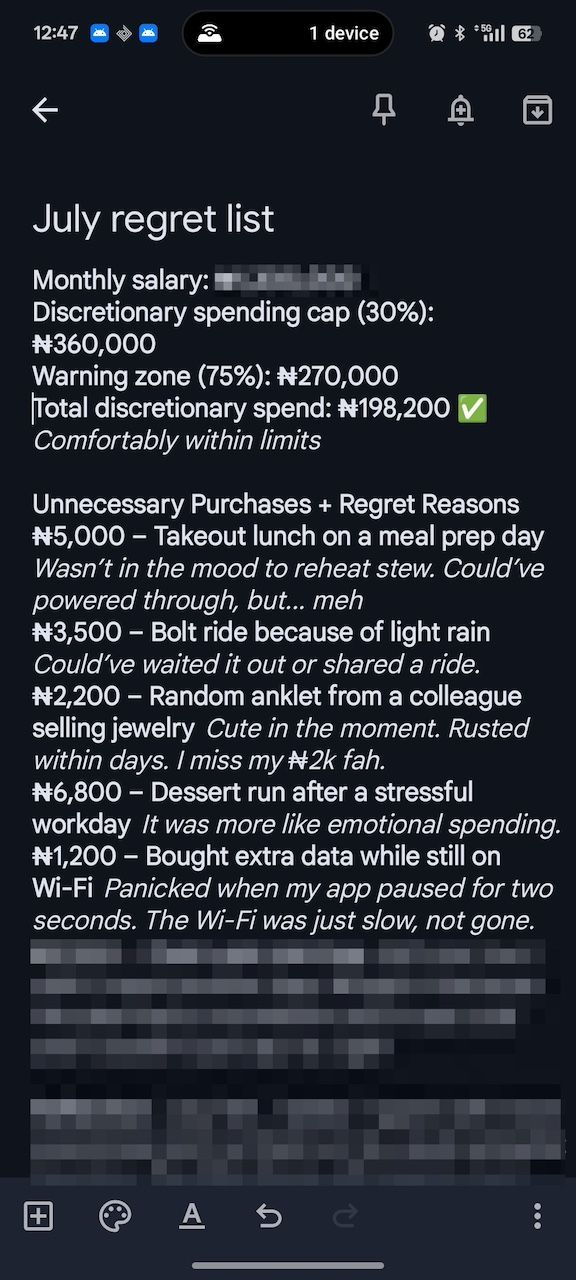

I use Google Keep to build my financial conscience. I write down my shopping budget and indicate a warning percentage. That’s a 75% calculation indicating that I’m dangerously close to overspending.

Then I list every unnecessary purchase I make daily, no matter how small. I also include prices and why I regret it.

The process forces me to confront wastefulness. By the end of the month, I scroll through it, and I’m reminded of my mistakes.

Slowly, I’ve conditioned myself not to repeat them.

6

Set geolocation warnings

I live in the middle of plazas and restaurants within walking distance. I can accidentally spend money simply by stepping out to get air.

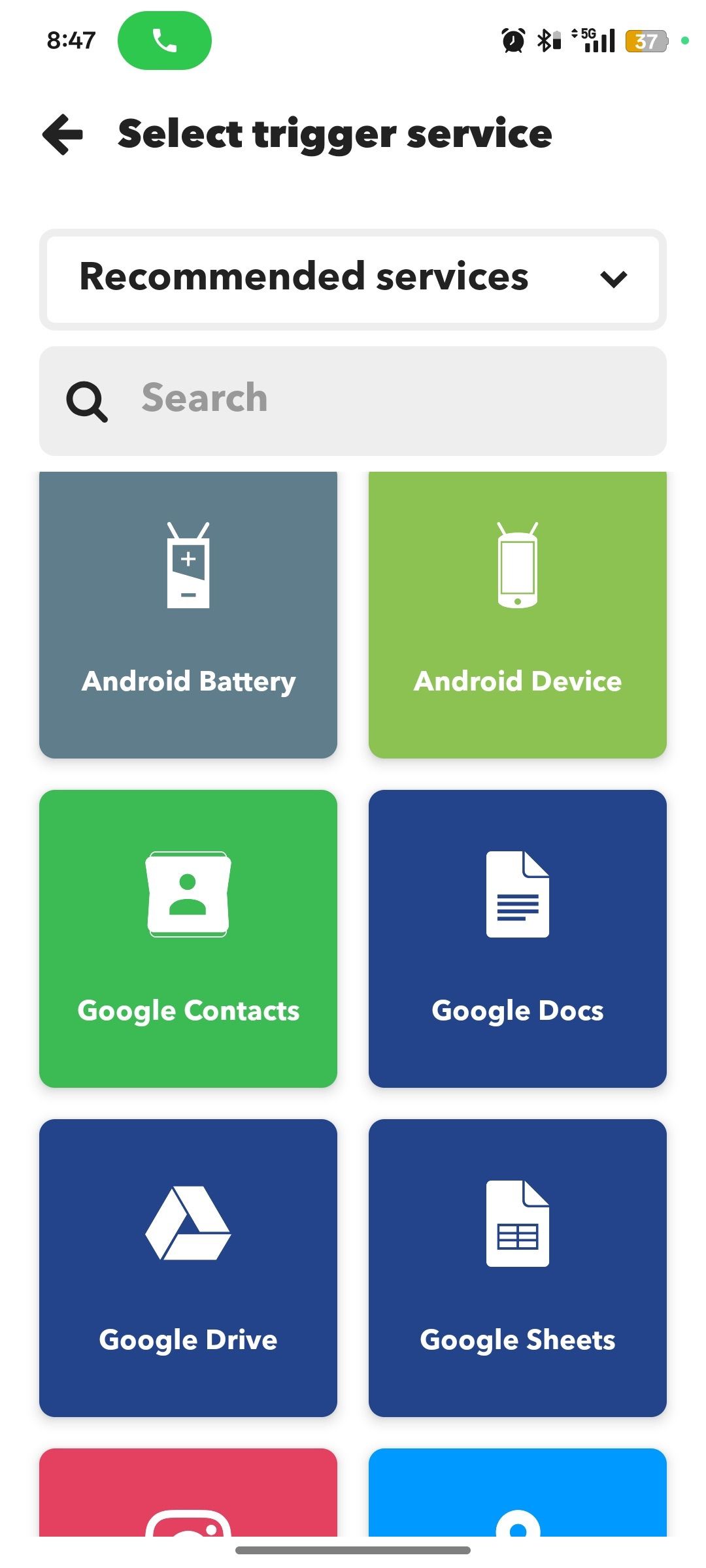

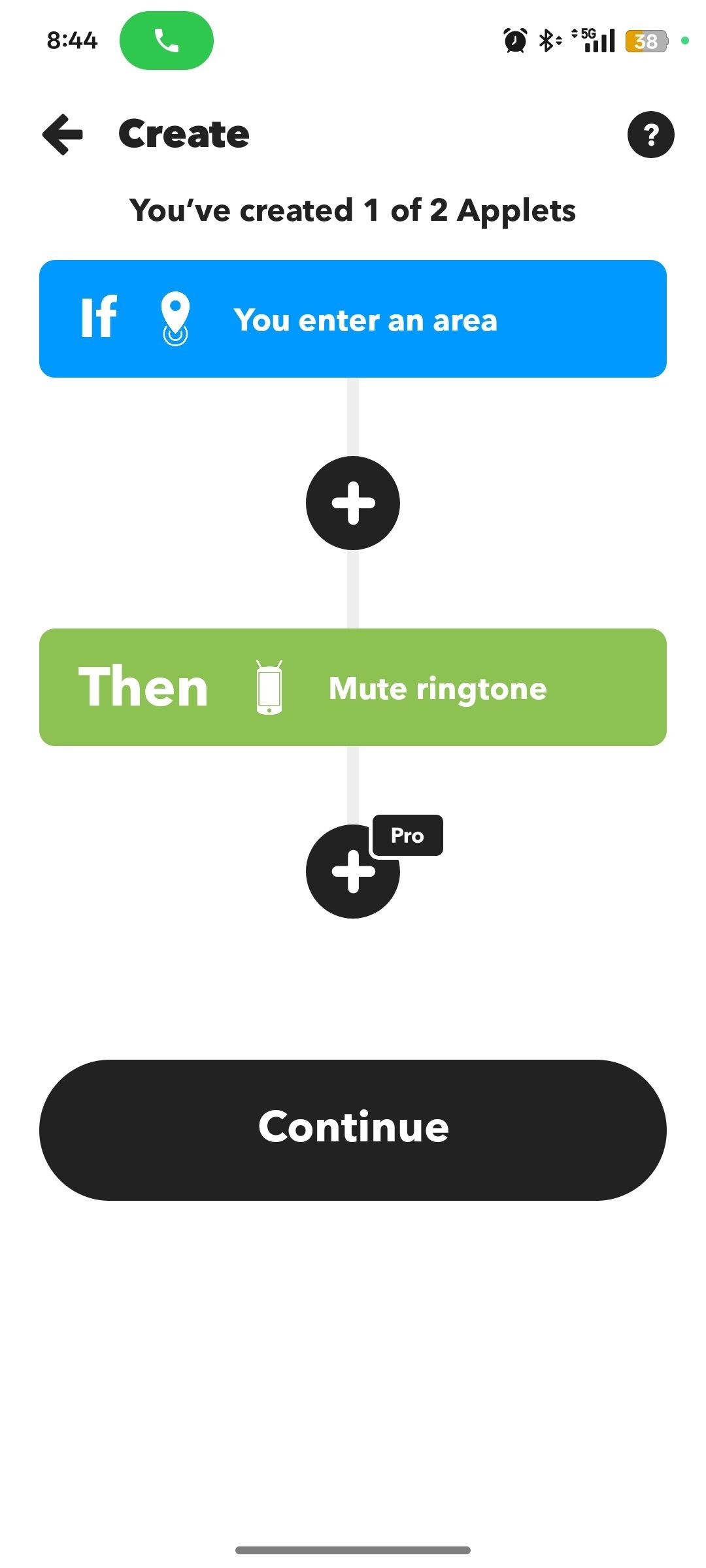

My configurations on the Tasker and If This Then That (IFTTT) apps save me from those moments. They allow me to create location-based notification triggers.

I’ve mapped my favorite spending zones. Immediately, when I approach any of those danger zones, my phone buzzes with a pre-written reminder. For example, “you don’t need anything here, so keep walking” or “Remember, don’t buy more than two items.”

IFTTT is simple to set up and requires no coding, which makes it great for beginners. But the free version limits how many custom triggers you can make.

Tasker is a powerful alternative if you’re comfortable with technical setups and want highly specific actions.

5

Schedule finance review events with friends

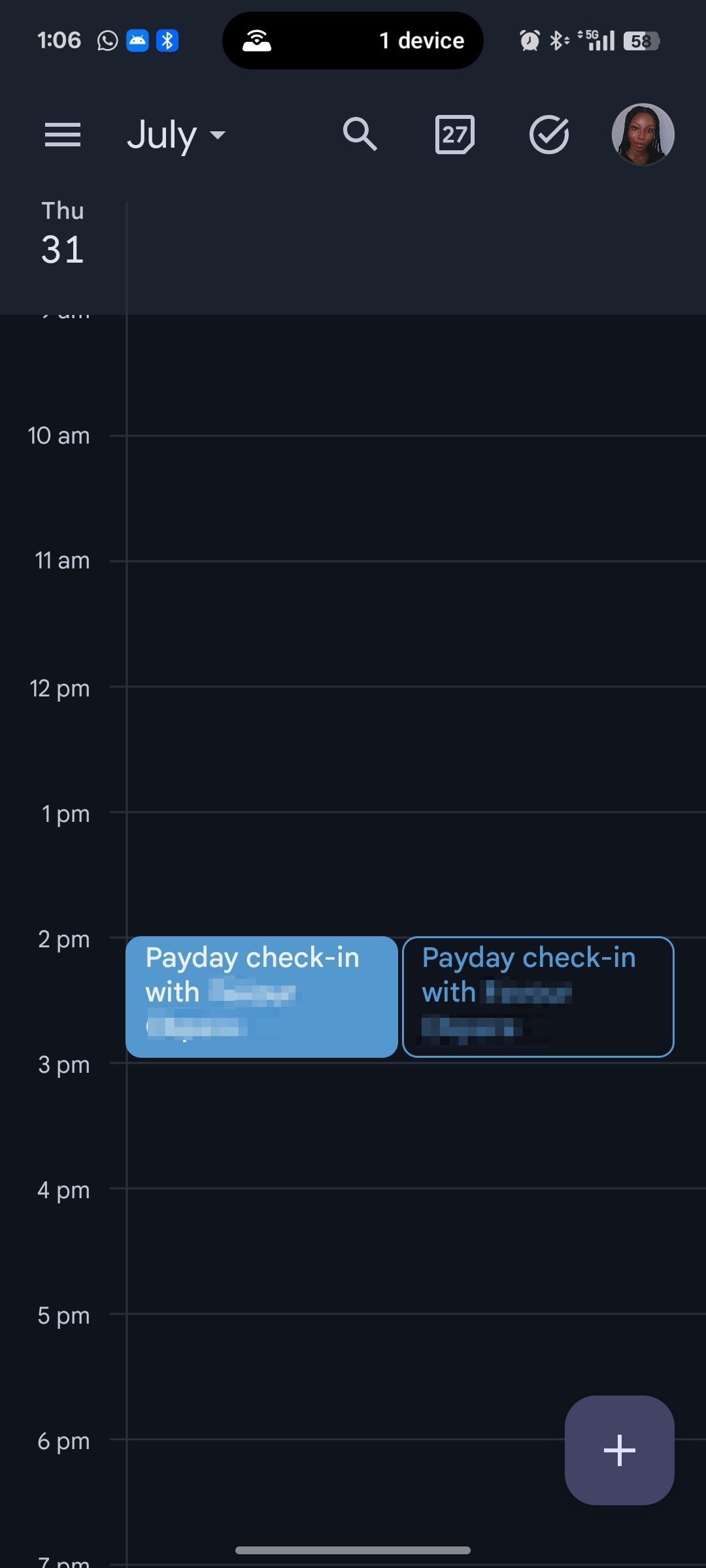

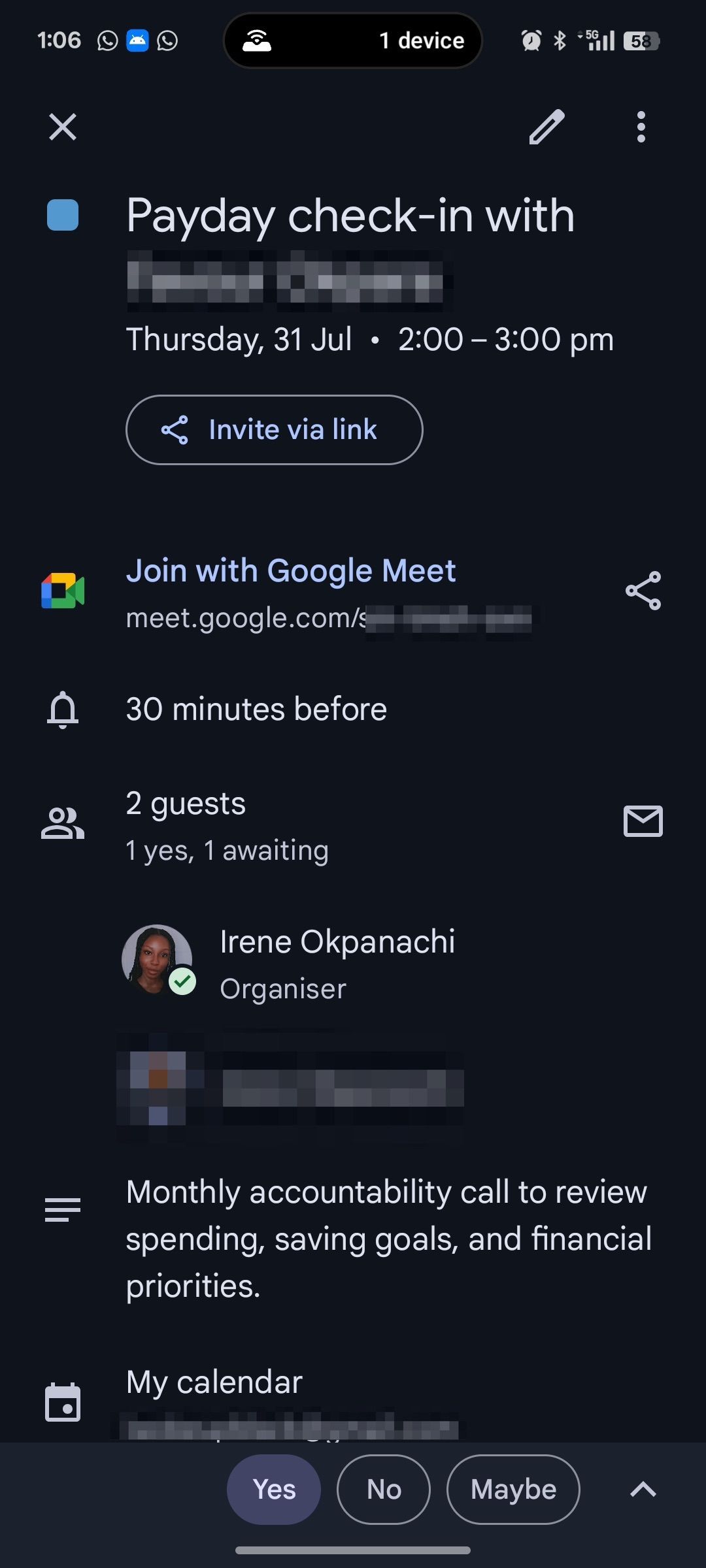

One underrated perk of using a shared calendar is how simple it makes accountability.

Money is a sensitive topic, and many people would rather pretend to have it together than let someone else in. Sharing one calendar event with someone you trust can change your life.

I have a friend who’s excellent with money, and we’ve built a system. I set a payday reminder event on Google Calendar and invited her as a collaborator.

We schedule calls via Google Meet or chat on WhatsApp to discuss saving strategies. She also gives feedback and suggestions.

You can do the same without exposing any bank account details. Simply create one recurring event and loop in someone you’re comfortable with. It could even be a paid financial adviser.

The pressure of being watched makes it easier to commit to your budget and savings.

Related

6 eco-friendly smart home habits that can also save you money

Cut your bills and more

4

Use app blocking timers

If you can’t beat your spending enablers, block them.

The Digital Wellbeing and Parental Controls menu on your Android phone lets you set daily timers for specific apps. But it’s easy to bypass.

I use third-party blocking apps from the Play Store for stricter control. Some require solving puzzles or entering a passcode. Others go as far as locking themselves from being uninstalled.

I’ve restricted my food delivery, social media, and shopping apps this way.

3

Apply the two-day rule

Rarely does impulse buying translate to need. If you can delay the purchase by at least 48 hours, you’ll see how unnecessary it is.

Delayed gratification creates a distance between me and irrational desires. During online window shopping, I take screenshots of my interests.

Then I save them to a dedicated album in my gallery app. I also save discoveries on Instagram to my collections. They act as receipts, even though a purchase hasn’t happened yet.

If I remember to, I revisit them after two days and reflect on what would have happened if I had bought them.

However, there are exceptions. If your phone charger or other important items need replacement, waiting 48 hours does more harm than good.

Time-sensitive deals on pre-planned items also count, especially when you’ve done your homework and waited for the right price.

The two-day rule protects you from emotional spending, not thoughtful decisions.

2

Use budget tracking apps

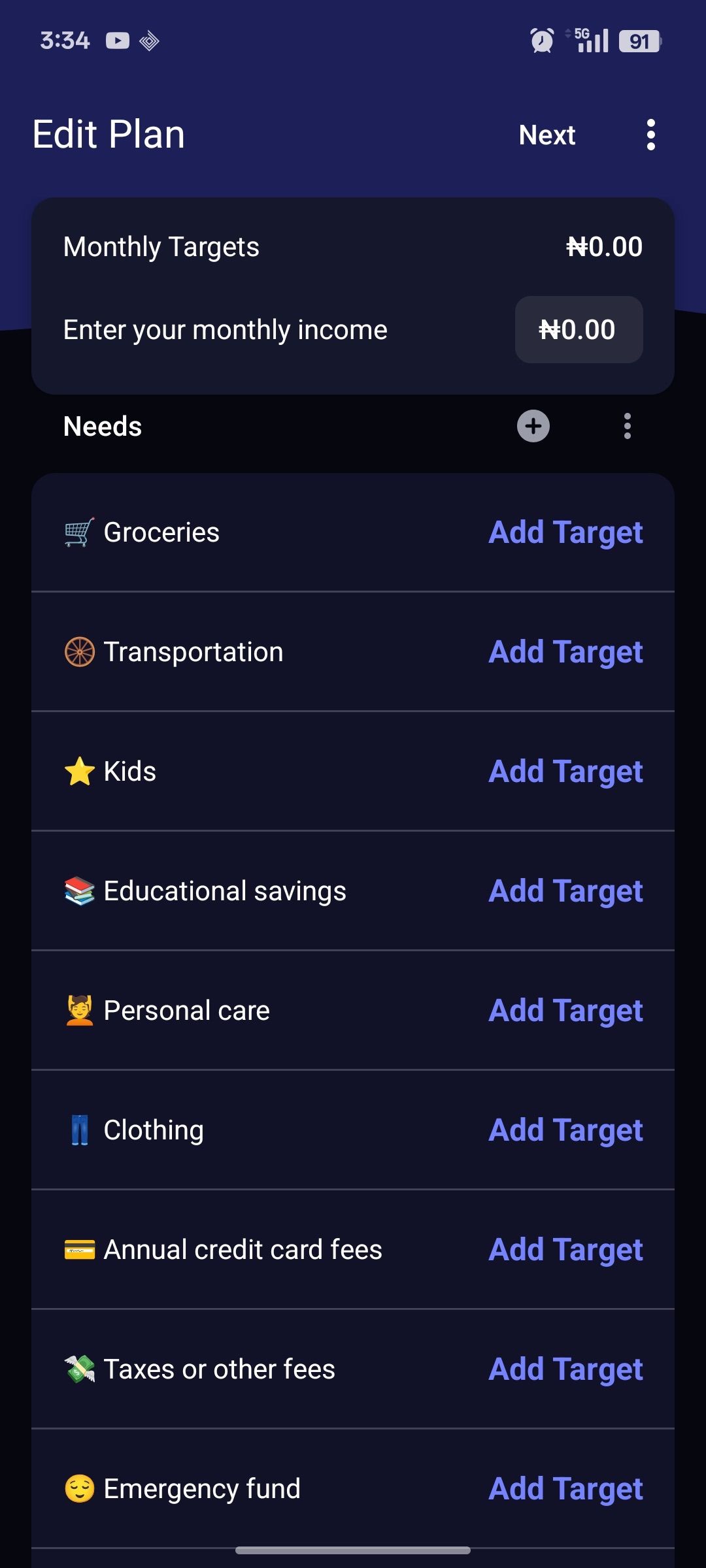

Pairing budget tracking apps with the aforementioned methods creates a stronger foundation for mindful spending. I use the You Need A Budget (YNAB) app to account for every dollar.

I manually distribute my income across groceries, wants or needs, mobile data, and other categories. You may also connect it to your bank accounts. The app helps me know what’s left to spend at the end of every month.

Its interface is visually appealing and emotionally intuitive. I prefer to use it instead of static rows and formulas on Google Sheets.

1

Ask ChatGPT for assistance

Deterrence is among the best forms of self-discipline. But it’s fragile in the wrong hands.

Some of my friends mean well, but they can be enablers when I need a firm no. I use ChatGPT as their replacement when I need a strict voice of reason.

Whenever there’s a pressing urge to buy something I shouldn’t, I open a fresh chat and ask it to stop me.

Example prompt #1: This [product] I want is on sale, and I might regret it if I don’t get it now. Is that scarcity marketing working on me? Help me look deep and decide if it’s worth buying in the long run.

Example prompt #2: I’ve added this [product] to my cart. I haven’t clicked buy, but I’m close. I need you to stop me and tell me everything that could go wrong with this choice. What will I feel like after? Will I regret it?

Example prompt #3: Please, justify why it’s not a good idea to buy this [product] right now. Include logical, emotional, and financial reasons. Pretend you’re the voice of my future self, looking back with either regret or relief.

Related

How I hack my way to cheaper trips with these 7 apps

Spend wisely, spend less

Cut your spending according to your means

Budgeting weaves into your lifestyle in different ways. If you zoom out, you’ll see that money slips through cracks you didn’t even know existed.

They could be hiding in unused streaming subscriptions you forgot to cancel or a data plan that’s excessive for your real needs.

The more honestly you look at your lifestyle, the more power you gain to shift it without sacrificing your comfort.